General Insurance Provider — Policy Lifecycle Orchestration (AML/KYC)

Summary

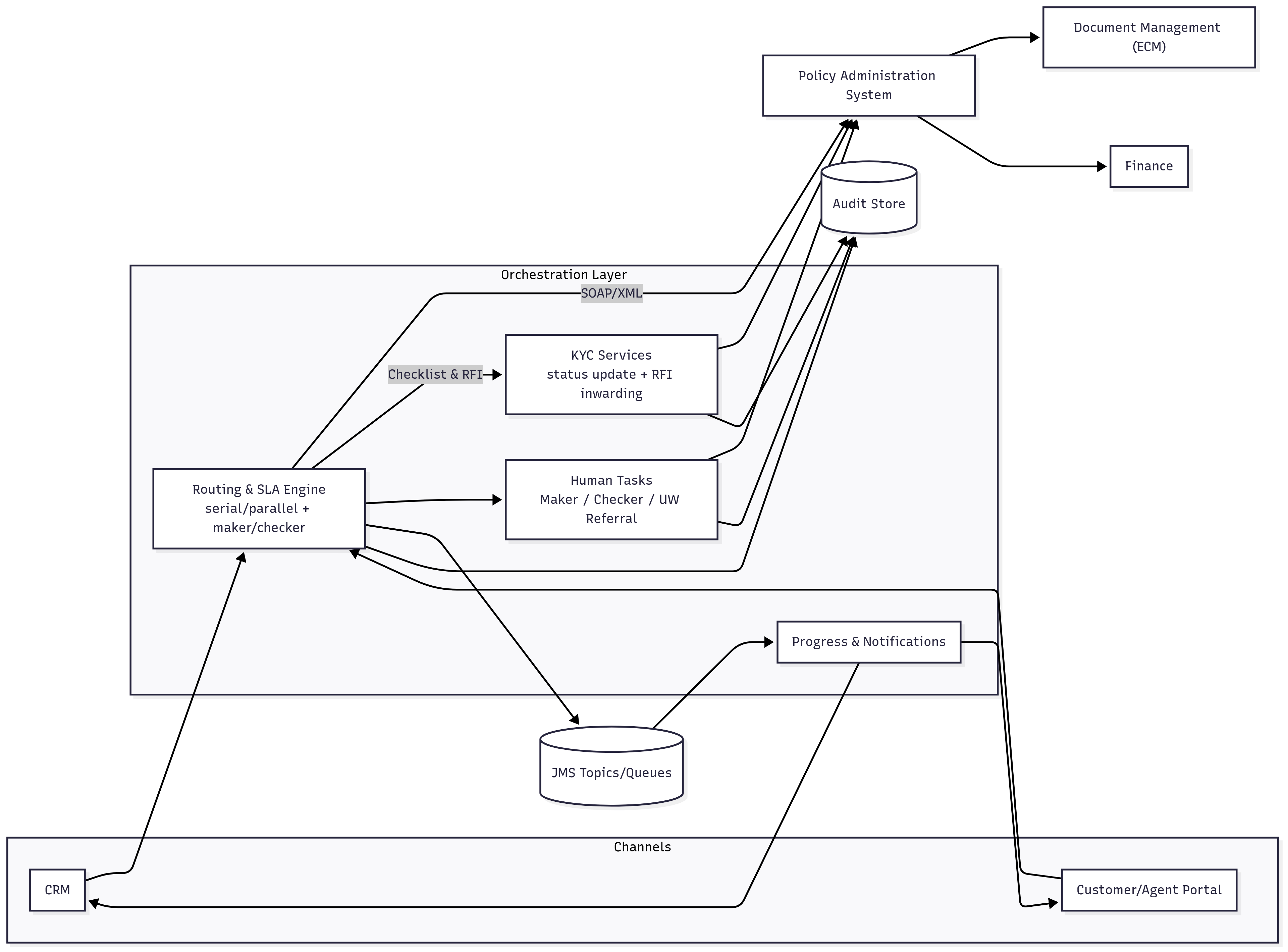

Designed and implemented end-to-end policy lifecycle orchestration across issuance, endorsements, renewals, and cancellations, embedding maker–checker approvals, dynamic serial/parallel routing, and AML/KYC branches. The platform unified CRM, finance, and document management, yielding faster turnaround, cleaner audits, and predictable customer updates.

Problem

- Fragmented steps across CRM, policy admin, finance, and document systems created handoff latency and lost context.

- Approvals lacked consistency: maker–checker enforcement varied by product and channel.

- AML/KYC checks were bolt-ons; required documents and status flags were not consistently propagated, raising compliance risk.

- Customers lacked transparency during endorsements and issuance, hurting CX and rework rates.

Solution Mechanics

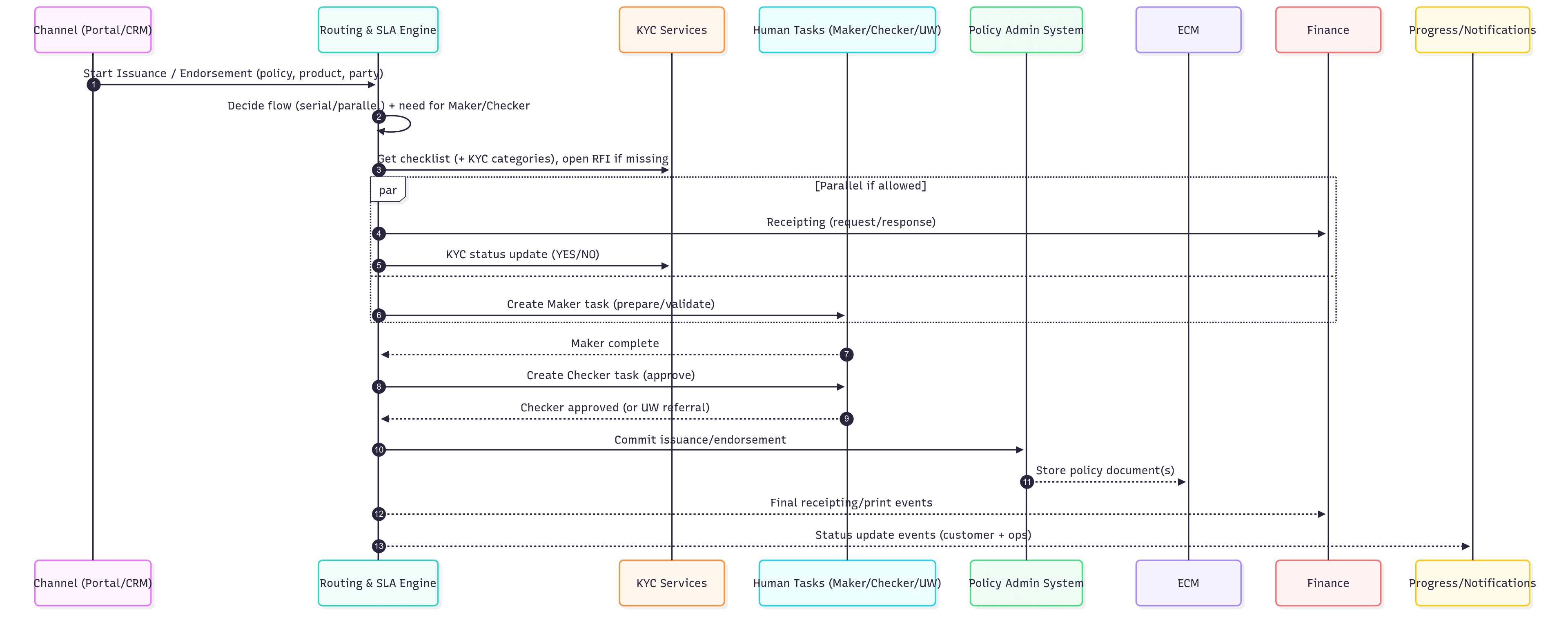

Primary pattern: API-led orchestration (request/response workflows with SLAs, human approvals, and partner callbacks).

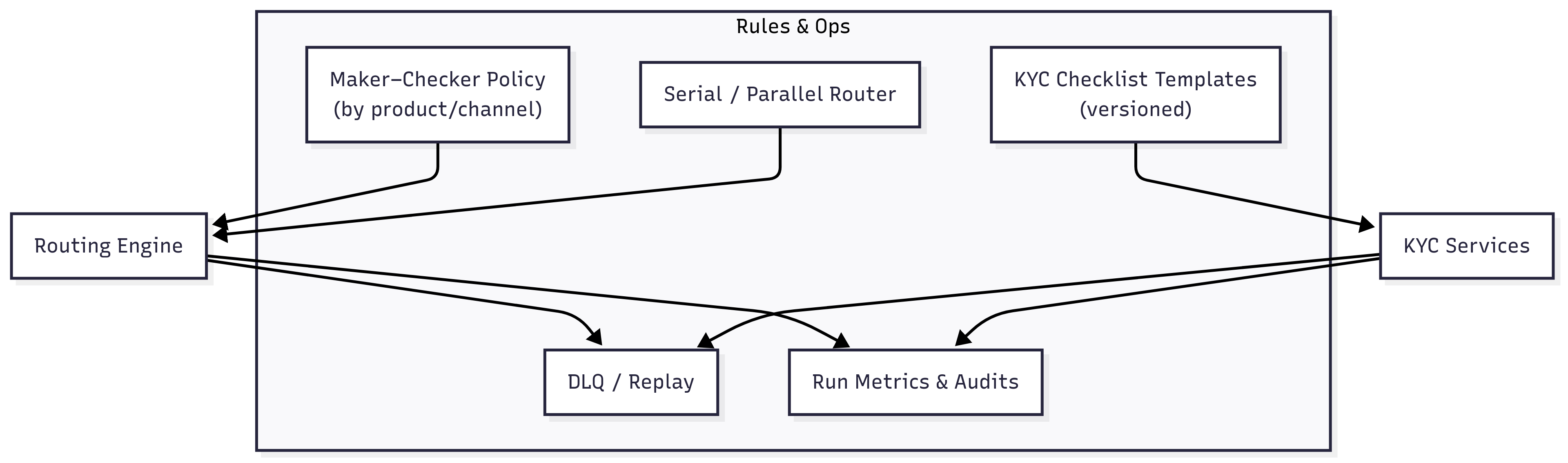

Secondary pattern: Rules/validation (maker–checker & KYC gating, product-driven serial/parallel routing).

-

Orchestration Layer (SOA services)

- Routes lifecycle requests from Portal/CRM to the Policy Administration System (COTS) via SOAP/XML adapters; all calls carry correlation IDs and idempotency keys.

- Implements GetFlowMode/GetNextStep decisions to choose serial vs parallel branches and whether to spawn Maker and/or Checker tasks.

- Exposes status & progress APIs for channels; enforces SLAs and timeout/retry budgets.

-

Maker–Checker & Human Tasks

- Creates Maker and Checker work items per product rules; supports UW referral paths.

- Custom task forms with consistent metadata (policy, party, amounts, evidence links).

- Role-based access and audit trails (who/what/when, before/after snapshots).

-

AML/KYC Branching

- KYC Status Update APIs to the policy system; KYC RFI Inwarding tasks when documents are missing.

- Inwarding Document Checklist service to fetch product-specific doc lists (including KYC categories) for Scanning & Indexing; drives RFI subflows.

- Parallel path supports Receipting while KYC evidence is gathered; serial path enforces strict sequence for products that require it.

-

Endorsements & Issuance

- Premium computation → Customer confirmation (endorsement) with negative path to exit if declined.

- Receipting integration; Printing/document generation; policy document storage in ECM with links persisted, not binaries.

- CRM updates at key milestones to keep customer-facing status accurate.

-

Integration & Data

- JMS topics/queues for work events, exceptions, and notification fan-out.

- ECM for artifact capture (scans, receipts, printed policy PDFs).

- Finance request/response for receipting and reversals; CRM for unified status.

- Append-only audit tables for decisions, approvals, KYC flags, and checklist versions.

-

Observability & Operations

- Progress service (policy number → current step, owner, ETA).

- DLQ/replay for failed calls; notification service for customer/ops comms.

- Runbooks for parallel branch hazards (e.g., receipting vs RFI), including async sub-process patterns to remove inter-branch locks.

Diagram 1 - Context Diagram — Policy lifecycle with AML/KYC, maker–checker, and channel updates

Diagram 2 - Sequence — New policy issuance with dynamic serial/parallel and KYC branches

Diagram 3 - Ops & Rules — Maker–checker policy, KYC checklist, DLQ/replay, and audit views

Process Flow

- Initiate: Portal/CRM requests Issuance or Endorsement → Orchestration resolves flow mode (serial vs parallel) and maker/checker needs for the product.

- Inwarding & Evidence: Create Inwarding task; fetch Document Checklist (incl. KYC categories) → Scanning & Indexing; open RFI subflow if items missing.

- Receipting: In parallel (if allowed) or serially per rule, perform receipting; post KYC status flags to policy system.

- Approvals: Spawn Maker (prepare/validate) and Checker (approve) tasks as configured; allow UW referral when risk thresholds hit.

- Issuance/Update: Commit issuance/endorsement in policy system; Print and store documents in ECM; update Finance/CRM.

- Notifications & Progress: Publish events; customers and ops see live status via Progress API; exceptions routed to DLQ with replay.

- Close & Audit: Persist approval trail, KYC artifacts, and checklist versions; emit audit events for compliance reporting.

Outcomes

- Faster issuance and endorsements through governed parallelization and consistent maker–checker.

- Audit-clean traceability of approvals, KYC flags, and document checklists by product.

- Improved CX via reliable status updates and fewer back-and-forth RFIs.

Strategic Business Impact

- Issuance/endorsement turnaround –15–30% (Proxy): driven by parallel receipting and pre-validated checklists.

- Compliance posture uplift (Proxy): standardized maker–checker and KYC updates reduce audit findings.

- First-time-right rate +10–20% (Modeled): fewer missing docs and misrouted cases due to product-aware routing.

Role & Scope

Led orchestration design and rollout: routing rules, maker–checker task model, KYC flows (status update + RFI inwarding + checklist), receipting & printing integration, CRM/Finance updates, and audit/observability (progress, DLQ/replay, notifications).

Key Decisions & Trade-offs

- Dynamic serial/parallel routing by product → higher throughput; required explicit async sub-processes to avoid branch locks.

- Maker–checker as policy (not app logic) → easier to evolve across products; needs versioned governance.

- KYC gating before issuance vs post-issuance remediation → better compliance; occasional longer path for strict products.

- ECM links vs binary in DB → performance and portability; mandates link governance and retention policy.

- Strict idempotency on policy/receipting calls → safe retries; added key management and conflict handling.

Risks & Mitigations

- Parallel branch contention (receipting waiting on RFI) → move one branch into async sub-process; set correlation gates.

- Checklist drift across products → central checklist service with versioned templates; nightly diffs.

- KYC false negatives → second-factor doc categories + manual override with audit reason.

- Callback timeouts → retries with backoff; circuit breakers and DLQ; operator prompts.

- Rework loops in endorsements → customer confirmation gate; auto-close on decline with full rationale logged.

Suggested Metrics (run-time SLOs)

- Issuance p95 and endorsement p95 (request → commit).

- Maker–checker rework rate and UW referral ratio.

- KYC exception rate and RFI closure time.

- Parallel branch success rate (no deadlocks) and DLQ depth/age.

- Audit event latency (action → audit record available).

Closing principle

Codify governance into the flow—let routing, maker–checker, and KYC rules decide pace and path, not handoffs.